Employee Open Enrollment 2026 - Health Insurance Benefits

Important Notes About Your 2026 Benefits

There have been increases to copays and out-of-pocket costs.

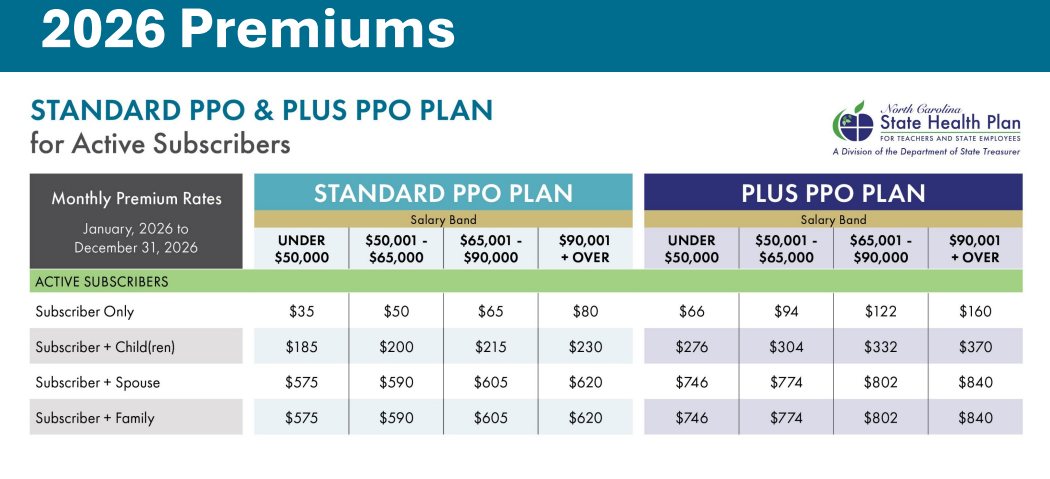

The Plan will be implementing salary-based premiums for 2026. Rates will be based on your current, total salary and will only apply to the subscriber-only rate.

Your subscriber-only rate will remain the same for 2026 regardless of salary adjustments unless a salary change occurs in the 1st quarter of 2026. If a change occurs during that time, your premium may change. Completing a tobacco attestation is no longer required to lower your monthly premium.

The Clear Pricing Project is ending Dec. 31, 2025. In 2026, the Plan is introducing Preferred Providers. These providers have been identified by the Plan as providers who are committed to improved access to high-quality, affordable health care. When you select and see one of these providers in 2026, you will pay the lowest copay for an office visit.

If you would like to change your selected Primary Care Provider (PCP) to a Preferred Provider, you will need to wait until after Jan. 1, 2026, to make that change. If your selected PCP is already noted as a Preferred Provider, you do not need to take any action. As a reminder, PCPs can be changed anytime, and ID cards typically arrive 7-10 days after the change is made.

The Plan is excited to be partnering with Lantern, a trusted provider that helps connect Plan members to a high-quality, carefully selected surgeon when you need a planned, non-emergency procedure. There will be no cost ($0) for the surgery for members who use a Lantern provider —no deductibles and no copays. Members will be getting more information directly from Lantern on this benefit. Medicare Primary members are not eligible.

The formulary (drug list), which determines what medications are covered and what tier they fall under, changes on a quarterly basis, so there is a possibility that you will have changes in your prescription coverage in 2026.

Preferred and non-preferred insulin continues to have a $0 copay for a 30-day supply.

Preventive Services remain covered at 100% – no copay or deductible – on either plan.